Purchase & Transfer Record

| Date | Buyer | Seller | Deed Type | Sales Amount | Conveyance # | Valid |

|---|---|---|---|---|---|---|

| 06/12/2020 | GOBLE DORA ANN TRUSTEE | GOBLE DORA ANN | NONE | $0.00 | 8566 | N |

| 07/25/2000 | GOBLE DORA ANN | GOBLE LLOYD NEIL & DORA ANN | NONE | $0.00 | 3081 | N |

Last Updated 9/10/2025 5:00 PM.

Payment History

| Date | Amount |

|---|---|

| 01/16/2025 | $2,246.91 |

| 07/18/2024 | $2,246.91 |

| 04/17/2024 | $2,471.60 |

| 02/14/2023 | $3,926.68 |

| 07/19/2022 | $1,992.50 |

| 02/18/2022 | $1,992.50 |

| 08/23/2021 | $4,626.07 |

| 10/01/2020 | $1,821.67 |

| 07/10/2020 | $1,505.51 |

| 02/22/2019 | $3,043.20 |

| 02/23/2018 | $2,975.36 |

| 02/24/2017 | $3,042.14 |

| 02/19/2016 | $2,896.68 |

| 02/20/2015 | $2,799.54 |

| 06/24/2014 | $1,599.53 |

| 02/05/2014 | $1,599.53 |

| 06/24/2013 | $1,598.45 |

| 02/15/2013 | $1,598.45 |

| 09/10/2012 | $176.31 |

| 04/06/2012 | $3,205.52 |

| 07/22/2011 | $1,366.44 |

| 01/31/2011 | $1,366.44 |

| 03/18/2010 | $140.25 |

| 03/15/2010 | $2,724.16 |

| 02/27/2009 | $2,679.58 |

| 02/29/2008 | $2,643.96 |

| 02/13/2007 | $2,592.50 |

Last Updated 9/10/2025 5:00 PM.

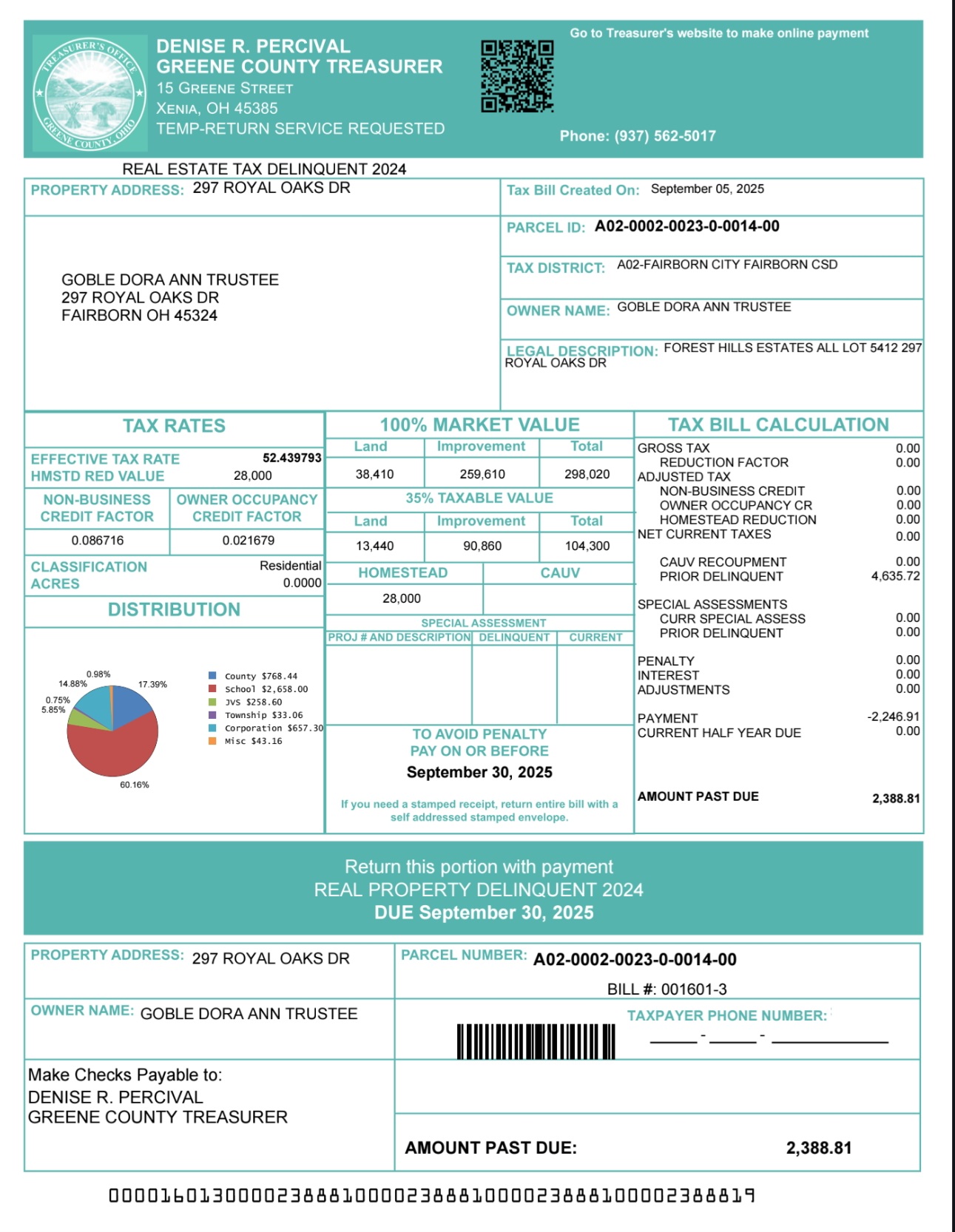

2024 Taxes

| Prior | First | Second | Total | |

|---|---|---|---|---|

| Gross | 0.00 | 4,385.36 | 4,385.36 | 8,770.72 |

| Credit | 0.00 | (1,650.55) | (1,650.55) | (3,301.10) |

| Non-Business Credit | 0.00 | (237.15) | (237.15) | (474.30) |

| Homestead | 0.00 | (229.11) | (229.11) | (458.22) |

| Owner-Occupancy Credit | 0.00 | (59.27) | (59.27) | (118.54) |

| Total Real Property Taxes | 0.00 | 2,209.28 | 2,209.28 | 4,418.56 |

| Real Property Tax Penalty | 0.00 | 0.00 | 217.16 | 217.16 |

| Total Taxes | 0.00 | 2,209.28 | 2,426.44 | 4,635.72 |

| Paid | 0.00 | 2,209.28 Paid | 37.63 Paid | 2,246.91 |

| Due | 0.00 | 0.00 | 2,388.81 Due | 2,388.81 Due |

NOTE: Second installment was due July 18 — unpaid as of Sept 10

View your bill

View your bill